Many people missed the opportunity to buy their first own house due to some financial myths and misconceptions:

- My credit scores are too low.

- Interest rates are too high right now!

- Prices are too high, I want to wait till it comes down.

- I don’t have enough down payment.

- I don’t have enough work history to qualify for a loan.

- Wanted to get married first before buying a home.

- I make more money in stock market.

- Why should I buy a house when I can rent? It cost the same!

My Credit Scores Are Too Low

Yes! You need a decent credit score to qualify for the lowest rate for a mortgage, usually a credit score of 620. However if you use any government backed loans like FHA and VA for your primary residence the score can be even lower.

You can fix your credit pretty quickly! There are ways to improve your credit by paying your debts on time, paying down your debt and most importantly check your credit report to see if there is any errors that you can dispute.

Even you don’t have the best credit score you can still qualify for a loan with a slightly higher rate. You can always refinance in later time when your credit score is at the optimal level or when rates fall.

Interest Rate Is Too High Right Now

Many people missed their boat because of the high interest rate. However, the price of the house doesn’t wait for you. If you see a house deal in the market and you don’t have a pre-approval letter from the lender to make a bid then you will regret it for life. Always get pre-approval even if the current interest rate is high, nothing is locked down yet. Even you get a 30 year mortgage with higher rate, you can always refinance it when the rate goes down in the future. If the rate doesn’t go down for the next ten year, then guess what? You already have the best deal for the rate! The important thing is that you don’t want to miss a good house deal!!

Prices Are Too High

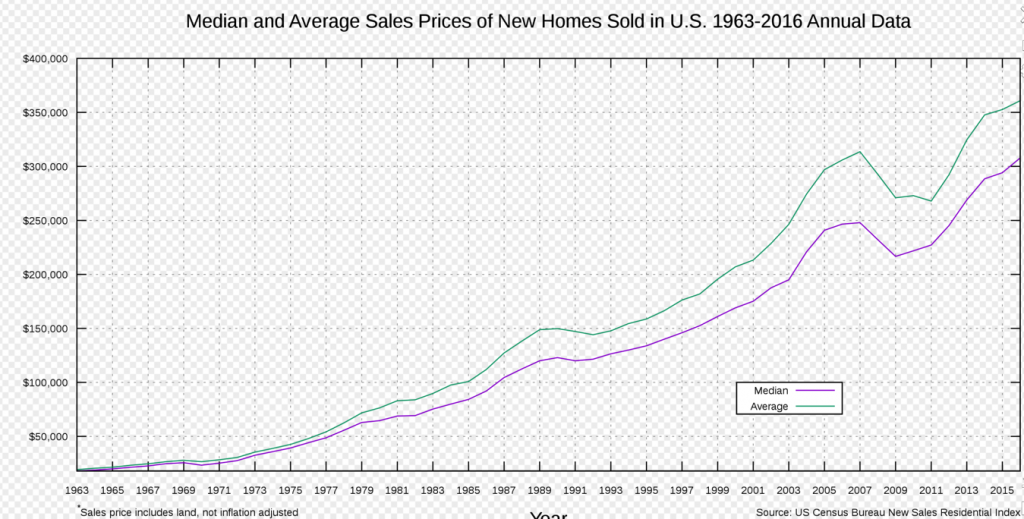

There is very hard to guess when will the housing market crash. The thing about your first house is that you are probably not going to sell the property in a short time period. Housing price is going to rise continuously along with inflation, sometimes even better than inflation. So if you income is sustainable to keep up with the mortgage even in the down market from 2007-2009, you will be fine because you can still afford it. After 2011 the housing resume the rise again.

I Don’t Have Enough Down Payment.

There are downpayment assistance programs out there, Federal and State (Well some states). At the Federal level we have FHA loan which for most cases, you can use it for a low downpayment from 3.5% to 10% based on your credit score. 3.5% downpayment still too high for you? Some state like California has state programs that can assist you with that 3.5% and closing costs, based on your income level, so you can have a close to zero downpayment!! Check your state program because each state has different programs to help home buyers.

Some expensive cities might have program or properties to help out lower income family to get their first home as well. Some might offer lower price properties to the market that can ONLY be sold to family or individuals in a certain income bracket. Make sure to check with local cities or county too for those deals.

You can also use a VA loan for a zero downpayment if you served in the military. It is a very good deal, but yes there are fees involved when you are trying to close a VA loan but you can lump them into your total loan amount so you can potential qualify for a loan to buy a property with zero down.

I Don’t Have Enough Work History to Qualify For a Loan

Usually lender would look at two years of work history in the same or related industry to underwrite a loan to potential buyers. This scared most of recent college graduates to even think about getting a house. However, there is a good news: As long as whatever you majored in is somewhat related to what your job is, you don’t need a full two year to qualify for a loan.

For example let say a nursing student just finish her nursing school a year ago and she has been working as a nurse for the past year. Her paystub can show that she is making a decent income and she studied that profession from school. A lender is most likely to grant her a loan for property.

Wanted to Get Married First Before Buying a Home

This one is a personal choice if you want to buy a home by yourself or with a spouse. From an investment standpoint, this shouldn’t stop anyone from buying a property that they can afford that is a good deal. There are couple things to consider:

- You can make quicker decisions on buying or not for a good deal by yourself

- Your spouse might not like the house that you like

- Your spouse might not have the same financial goal as you do

Let say for example you want to buy a fourplex or duplex as your first home, you can collect rent and cover most of your mortgage so you can pretty much live for free in a property that will appreciate in value. However, your spouse doesn’t like the idea of having neighbors sharing the same wall. Deal is off and you buy a house with the same price, your dream to be a landlord making passive income with 2-4 doors will need to wait.

Go for the property you can afford now! Let it build equity, so in the future you can buy your dream home with your spouse/family.

I Make More Money In Stock Market

If you are making good money in stock market and don’t mind paying rent, that is all good. But from an investment standpoint, you might want to get a house anyways for diversity. The stock market is tricky, if you are day trading… then most likely you will lose money. If you been constantly making money since you start your day trade journey then write a comment here because I want to learn from you.

Have a diversify portfolio is essential for good financial health. Stock market can crash any time, sometimes it can make a significant financial impact for some people. Having property is important to diversify your investment and you can actually live in it. It is also great to fight inflation too. As we are experiencing hyper inflation now in 2022, everyone just wished that they have some real property because they are appreciating far higher than inflation.

Why Should I Buy a House When I Can Rent? It Cost The Same!

Rent might cost the same as mortgage payment right now but will it be the same for the next 2-3 years? How much 10 years? 30 years? If you have a 30 year fixed mortgage payment, you will be paying the same amount for the next 30 years and only pay property tax and insurance after 30 years.

Not all cost in mortgage goes down the drain like rent. When you are paying rent you are paying your landlord, nothing goes to your pocket. But when you paying a mortgage, a percentage of that mortgage payment is going to cover your principle of your loan, which mean it belongs to you. It is your asset.